Here's how you can protect your family and prepare for the unexpected

While we can’t stop unfortunate situations from happening whether that’s dealing with the loss of a loved one, getting ill or injured, or losing financial assets, we can definitely plan for them to minimize their impact on our lives.

No one thinks of falling ill or getting injured, and we want to believe that if we do all the right things and focus on all the positivity, we will be fine.

But unexpected situations can happen anytime. Take COVID, for example, no one thought we would be dealing with a pandemic for as long as we are or how it would impact us physically, financially, and emotionally.

While we can’t stop unfortunate situations from happening whether that’s dealing with the loss of a loved one, getting ill or injured, or losing financial assets, we can definitely plan for them to minimize their impact on our lives.

But how do you plan for unexpected situations?

To ensure you and your loved ones are protected from any situation that life throws at you, we have added additional options to help you plan for an emergency in our new release!

Introducing Emergency Scenarios

Emergency Scenarios allow you to provide detailed instructions to your Trusted Parties and grant them access to specific records when the unexpected happens.

You can now create custom emergency scenarios and share them with your trusted parties to make sure that you and your family are protected.

How to access it?

Just go over to the Emergency Scenario in the navigation bar and click on Create New Scenario to add information.

You can be as detailed as you want and can even include any instructions for your trusted parties.

Once you’ve added all information and assigned trusted parties, simply click on Enable to action your emergency scenario, and voila! Your Trusted parties can now access them.

What’s the difference between an Emergency Scenario and My Legacy?

The Emergency Scenario lets you assign a few records that can be accessed by your Trusted Parties based on specific conditions. These scenarios can be about anything you find important like what you would like to happen if you fell ill, injured, or were involved in an accident. You set each scenario and assign trusted parties who you trust to action it.

Whereas, My Legacy includes everything from your will and power of attorney to online banking. My Legacy is used in the event of the most extreme circumstances; Once your Trusted Parties are granted access, it provides everything in your Vault (except for Confidential records).

Is there anything else?

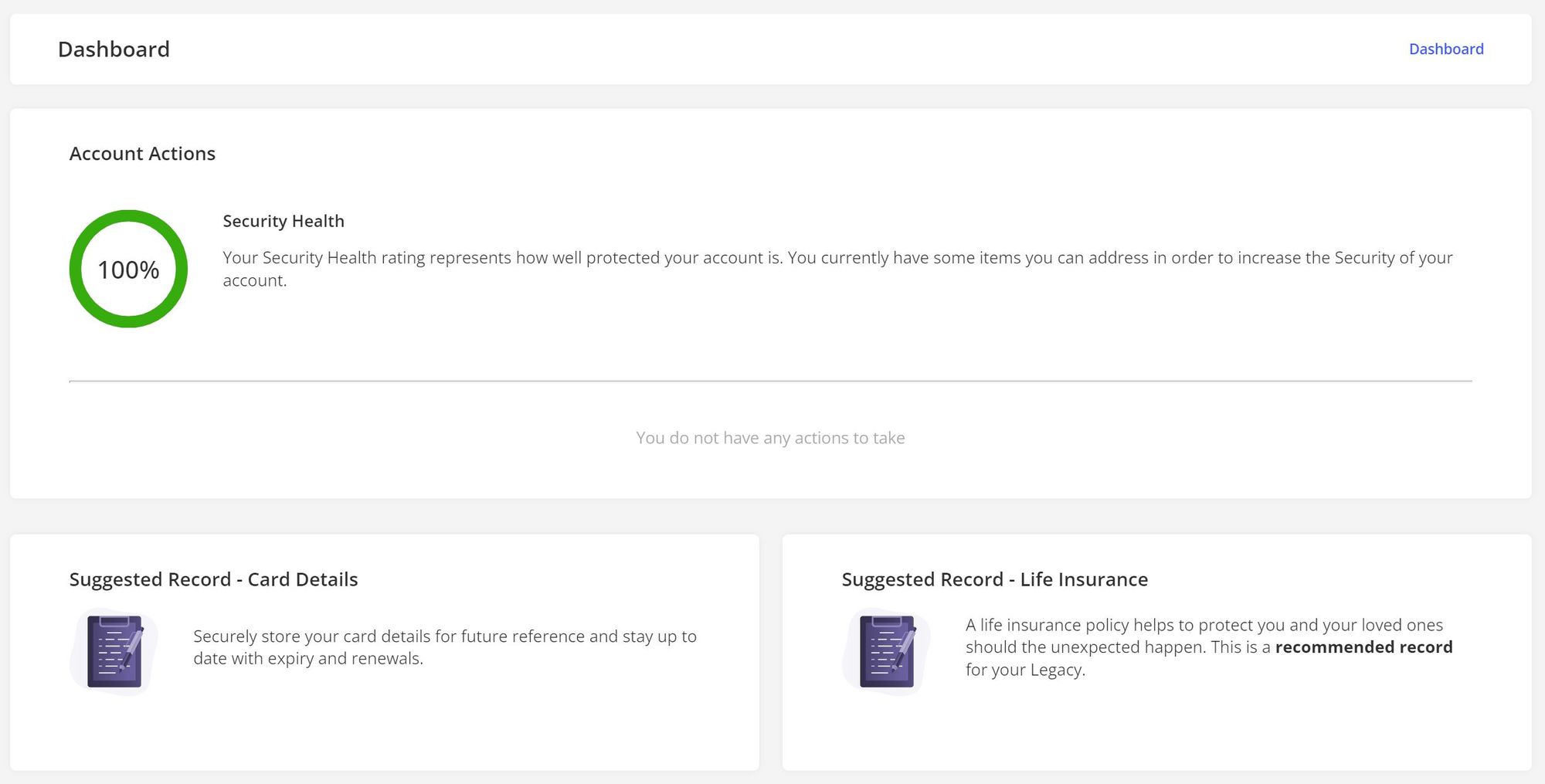

Yes, we have added a Dashboard to ensure you will constantly be updated on the most critical aspects of your Vault, whether that is your account security or recommended records we think you could add to your vault.

Once you complete the Onboarding, you can access your account’s security status to see if your information is safe. We recommended regularly reviewing it to ensure your data is always kept secure and aim to receive a rating of 100%.

If for some reason, you have a lower rating you can review what activity is causing it and take steps to amend it. This will ensure you have the best account security possible.

To stay up to date on the latest product news, make sure you subscribe to LifeBlog.

If you would like to learn more about how LifeReady can help you organize, store and share your important life information, or try out our platform contact us here: lifeready.io